Understanding Your Health Savings Options: HSA and FSA Explained

Trying to manage healthcare costs can feel overwhelming, but you don't have to navigate it alone. Many people find saving for medical expenses confusing, and that's completely understandable. Thankfully, accounts like a Health Savings Account (HSA) or a Flexible Spending Account (FSA) can help. These special, tax-advantaged accounts let you set aside pre-tax money for qualified health expenses, which lowers your overall taxable income and helps your savings go further.

In this guide, we’ll gently explain the key differences between HSAs and FSAs, so you can confidently choose the right path for your health and financial well-being.

What is a Health Savings Account (HSA)?

An HSA works like a personal savings account, but it’s created just for your health-related expenses.

- Who is eligible? To open and contribute to an HSA, you’ll need to be enrolled in a high-deductible health plan (HDHP). For 2026, the IRS has confirmed that those thresholds will rise to $1,700 (individual) and $3,400 (family).¹

- How contributions work: Money can be added to your HSA by you, your employer, or even a family member. These contributions are made with pre-tax dollars, which directly lowers your taxable income for the year. For 2026, you can contribute up to $4,400 for self-only coverage or $8,750 for family coverage.¹

- The money is always yours: One of the best features of an HSA is that the money belongs to you, no matter what. If you change jobs, switch insurance plans, or retire, the account and the funds in it go with you.

- Your savings can grow over time: Unlike other accounts, your HSA balance rolls over every single year—there’s no “use-it-or-lose-it” rule. Even better, many HSAs allow you to invest your funds, giving them the potential to grow tax-free and create a healthy nest egg for the future.

- Flexible contribution deadline: If you need a little extra time, you can usually contribute to your HSA for the previous year right up until the tax filing deadline, which is typically April 15th.²

What is a Flexible Spending Account (FSA)?

A Flexible Spending Account (FSA) is a special account you can get through your employer that helps you save on healthcare costs.

- Who is eligible? If your employer offers an FSA as part of your benefits package, you are generally eligible to enroll, no matter what kind of health plan you have.

- How contributions work: You add money to your FSA through automatic, pre-tax deductions from each paycheck. The 2025 FSA contribution limit is $3,300. Looking ahead, several major benefits consulting firms are projecting a further increase to $3,400 in 2026. That number is not yet official, as the IRS typically releases its finalized limits each fall through a formal Revenue Procedure.3,8,9

- Understanding the “use-it-or-lose-it” rule: This is the key difference between an FSA and an HSA. In most cases, you need to use the money in your FSA within the plan year. To make this easier, many employers offer one of two helpful options (but not both):

- A grace period, giving you an extra 2.5 months to spend your funds.

- A carryover, allowing you to roll over up to $660 into the next year (for plan years ending in 2025).⁴

- It’s connected to your job: Since an FSA is an employer-sponsored benefit, it isn’t portable. This means if you leave your job, you usually forfeit any remaining funds in the account.

HSA vs. FSA: Which is Right for You?

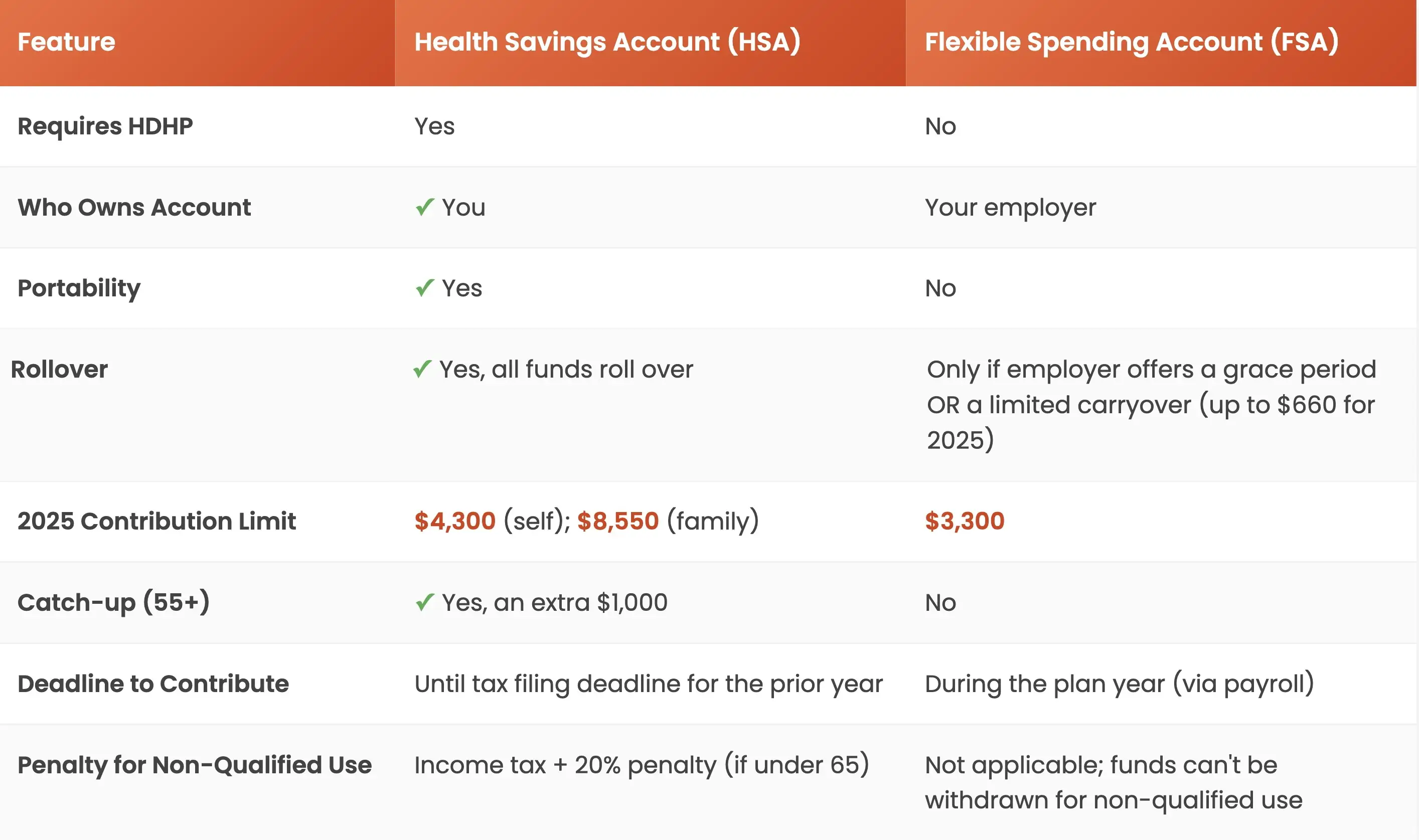

While both accounts help you save on healthcare expenses, they have key differences designed for different needs. Understanding these distinctions is the best way to decide which path is right for you.

Here’s a simple breakdown of the main differences:

- Ownership: An HSA is a personal savings account that you own and take with you, even if you change jobs. In contrast, an FSA is owned by your employer and is tied to your current job.

- Eligibility: To contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). For an FSA, any employee is eligible as long as their employer offers it, regardless of their health plan type.

- Rollover Rules: HSA funds roll over in full every year, allowing you to build up a balance over time. FSAs have a “use-it-or-lose-it” rule, where you generally must spend the funds within the plan year (though some employers offer a small carryover or a grace period).

- Fund Availability: With an FSA, your entire annual contribution is available on day one. With an HSA, you can only spend the money that has actually been deposited into the account.

- Investment Potential: An HSA acts like a long-term investment account for healthcare, as the funds can be invested to grow tax-free. FSAs are spending accounts and cannot be invested.

A Note on HSAs for Older Adults

HSAs become even more powerful with age. Starting at 55, you can contribute an extra $1,000 per year as a "catch-up" contribution.⁵

After you turn 65, the account becomes more flexible: you can still use the money tax-free for qualified medical expenses, but you can also withdraw funds for any other reason without a penalty. The amount you withdraw is simply added to your annual income and taxed accordingly.⁶

An HSA might be a great choice if: you have a high-deductible health plan and want a long-term savings tool that you control completely. The ability to invest your funds makes it a powerful way to plan for future health costs, even into retirement.

An FSA might be a better fit if: you don't have an HDHP or if you expect predictable medical expenses in the coming year. Having access to your full contribution on day one can be a major advantage for planned procedures or purchases.

How to Use Your HSA and FSA Funds

Both HSA and FSA funds can be used for a wide range of “qualified medical expenses.” This includes everything from doctor’s visits and prescription drugs to everyday health items. While the official list from the IRS is long, most eligible expenses fall into a few key categories.

Common Eligible Expenses:

Medical Services: Co-pays for doctor visits, hospital bills and diagnostic tests.

Dental and Vision Care: Routine cleanings, fillings, prescription eyeglasses, contact lenses, and eye exams.

Prescription & OTC Items: Prescription medications and many over-the-counter (OTC) products like pain relievers, cold medicine, allergy pills, and bandages.

Medical Equipment: Devices like blood pressure monitors and glucose testing kits, as well as supplies like crutches, first-aid kits and pill organizers.

Personal Health & Wellness: Feminine care products, breast pumps and supplies, and smoking cessation programs.

Mental Health Services: Psychotherapy, counseling, and treatment for substance use.

Essential Transportation: The cost of travel to and from medical appointments, including bus fare, mileage, or ambulance services.

It's good to remember that some expenses, like vitamins or weight-loss programs, may require a Letter of Medical Necessity from your doctor to be eligible.³

An Easy Way to Shop

Many people find it helpful to use online retailers like the FSA Store or HSA Store. These websites only sell eligible products, so you can shop with confidence knowing everything is approved. We explore this in more detail in our guide to using the FSA store.

What Isn’t Covered?

It's also important to know what isn’t covered. Expenses for general wellness, such as gym memberships, cosmetic procedures, and most nutritional supplements, are typically not eligible unless prescribed by a doctor for a specific medical condition. Always check your plan’s specific guidelines before you spend.

Your Funds Can Do More Than Just Buy Supplies

Beyond individual products, your HSA or FSA funds can also be used for comprehensive services that simplify your health routine and provide peace of mind. This is where a complete medication management service can be a perfect fit.

Use Your Health Savings for Total Peace of Mind

Most people use their Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) for expected costs like co-pays and prescriptions. However, these pre-tax funds are also designed for a broader range of crucial services that support your daily health and well-being such as managing medications

The Hero end-to-end medication management service is a qualified medical expense, making it a perfect use for your HSA or FSA funds. A Hero subscription helps you or a loved one stay safely on track with medication, which is a cornerstone of managing long-term health.

Your pre-tax dollars can cover the full subscription, which includes our award-winning smart dispenser, the connected medication management app, and access to 24/7 live support. By using your HSA or FSA funds for Hero, you’re choosing a service that helps reduce the daily stress of medication management and empowers you to focus on what matters most.

Complex med schedule? We solved it.

Hero’s smart dispenser reminds you to take your meds and dispenses the right dose, at the right time.

A Few Final Tips for Your Journey

- Keep Good Records: It’s always a good idea to hold onto receipts and any Letters of Medical Necessity from your doctor. This makes it easy to confirm your withdrawals were for eligible expenses if you ever need to.

- Navigating Job Changes: An FSA is tied to your employer, so if you plan on changing jobs, check your plan’s rules. You’ll often need to spend the remaining funds before your last day.

- Stay Up to Date: The IRS occasionally adjusts contribution limits and rules. A quick check of the official guidelines each year will ensure you have the latest information for your planning.

Take the Next Step with Confidence

Choosing between an HSA and an FSA is a personal decision, but both are powerful tools for making healthcare more affordable and less stressful. By understanding how they work, you can make a confident choice that helps you save money, simplify your routine, and, most importantly, give you one less thing to worry about.

References:

- Internal Revenue Service. Revenue Procedure 2025-19: Health Savings Accounts (HSAs) and High Deductible Health Plans (HDHPs) — Inflation Adjusted Amounts for 2026. U.S. Department of the Treasury. Published May 9, 2025. https://www.irs.gov/pub/irs-drop/rp-25-19.pdf

- Internal Revenue Service. Instructions for Form 8889. IRS. https://www.irs.gov/pub/irs-pdf/i8889.pdf

- Internal Revenue Service. Healthcare FSA reminder: Employees can contribute up to $3,300 in 2025; must elect every year https://www.irs.gov/newsroom/irs-healthcare-fsa-reminder-employees-can-contribute-up-to-3300-in-2025-must-elect-every-year

- Healthcare.gov. People with coverage through a job https://www.healthcare.gov/have-job-based-coverage/flexible-spending-accounts/

- Internal Revenue Service. Publication 969 (2024), Health Savings Accounts and Other Tax-Favored Health Plans https://www.irs.gov/publications/p969

- Healthcare.gov. Understanding HSA-eligible plans https://www.healthcare.gov/high-deductible-health-plan/hdhp-hsa-work-together/

- Internal Revenue Service. Publication 502 (2024), Medical and Dental Expenses https://www.irs.gov/publications/p502

- Mercer. Mercer projects 2026 transportation and health FSA limits. Published September 2025. https://www.mercer.com/en-us/insights/law-and-policy/mercer-projects-2026-transportation-and-health-fsa-limits/

- Employee Benefits Corporation (EBC). 2026 Projected FSA and Commuter Limits. https://www.ebcflex.com/2026projectedfsacommuterlimits/

The contents of the above article are for informational and educational purposes only. The article is not intended to be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified clinician with any questions you may have regarding a medical condition or its treatment and do not disregard professional medical advice or delay seeking it because of information published by us. Hero is indicated for medication dispensing for general use and not for patients with any specific disease or condition. Any reference to specific conditions are for informational purposes only and are not indications for use of the device.